Đăng ký Tài khoản Online

Quét mã QR, tải App

TPBank Mobile trên

Play Store & App Store

Cài đặt & mở

Tài khoản Online

trong 5 phút

QUÉT MÃ QR TẢI APP TPBANK MOBILE TẠI ĐÂY

Nhận 1001+ lợi ích và ưu đãi với Tài khoản TPBank

MIỄN PHÍ

Chuyển tiền và 60+ loại phí

HOÀN TIỀN 1,2%

Với Thẻ TPBank Visa

CHỌN SỐ TÀI KHOẢN

Theo ý thích, khẳng định cá tính

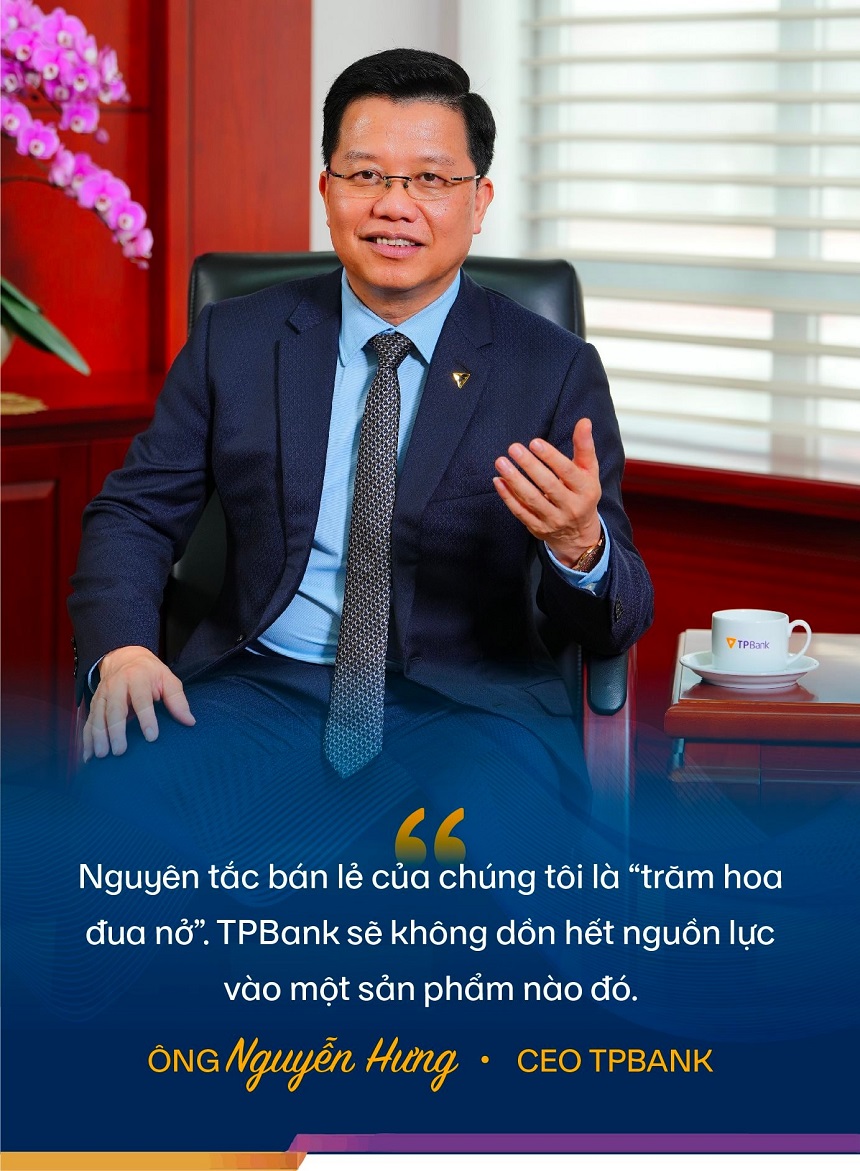

CEO of TPBank Decodes the Retail Banking Strategy of ‘FMCG Combined with Gold, Silver, and Gemstones’

TPBank has the branch network size of a mid-sized bank, but its number of individual customers is on par with that of a top-tier bank. This is the result of a distinctive retail strategy, stemming from the unique mindset of its senior leadership.

In a conversation with us, Mr. Nguyen Hung – CEO of TPBank – shared that TPBank is a "latecomer" in the banking industry. Meanwhile, the expansion of branch networks has been tightly regulated in recent years, with banks allowed to open only 5 new branches per year. Relying solely on a traditional network, TPBank would not be able to catch up with long-established banks. Therefore, the bank has had to continuously seek new growth avenues.

Currently, TPBank has approximately 13.5 million individual customers and nearly 200,000 corporate clients. The bank's individual customer base has grown multiple times over in just the past five years, now on par with many of the leading private banks. TPBank has a retail portfolio where 60% of its loan book is made up of individual customers, totaling nearly 150,000 billion VND. Its CASA ratio exceeds 20%, placing it in the top 5 banking systems in Vietnam.

The Turning Point in Banking Thinking

Interviewer: Mr. Hung, retail banking services often seem quite similar across different banks, yet TPBank stands out with something very unique, such as being a pioneer in digital banking. Is technology the key factor that sets TPBank apart in its retail strategy, or is it due to the fact that the bank's leaders come from the FMCG industry?

Mr. Nguyen Hung: Actually, technology is one of our strengths, with our digital banking services being widely used and appreciated by customers. However, the core factor that differentiates our retail strategy comes from a change in the way we think about customer service at TPBank many years ago.

It was a shift from traditional banking practices to a service model that puts the customer at the center, where everything must start with the customer. This is very similar to the business approach of the FMCG (fast-moving consumer goods) industry.

In the past, the banking sector was viewed as prestigious, and banks often catered to depositors, while borrowers were seen as inferior. Bankers would often think of themselves as the ones in control, with customers needing to "beg" for loans. But clearly, this is not the right way to approach things.

To provide good service, that mindset has to be abandoned, even if you’re the one with money, the creditor. This is the mindset that the new leadership at TPBank brought with them.

Indeed, our distinctive retail strategy was influenced by practices from the FMCG sector. This combination wasn’t something taught in schools or from textbooks; TPBank had to explore and create its own way of implementing it.

The most obvious thing we learned from the success of Mr. Phú and Mr. Tú (Mr. Đỗ Minh Phú – Chairman of the Board, and Mr. Đỗ Anh Tú – Vice Chairman of the Board) in the FMCG industry is marketing and how to organize effective sales channels and sales teams. What most people don't know is how to build and design products.

How Has the FMCG-Oriented Mindset Transformed TPBank's Product and Service Offerings?

Successful FMCG companies are very good at what they do. They must conduct thorough research into customer needs and focus heavily on the customer right from the start. TPBank has learned from the FMCG industry that delivering products and services must begin with understanding customer needs. A clear example of this is TPBank being the first bank in the market to offer auto loans, even when large banks—both state-owned and joint-stock—had not yet recognized this customer demand.

At TPBank, the Product Council is very focused on details and on how customers perceive and use our services. Therefore, our products and services are designed to be as closely aligned with customer needs as possible, making them as convenient as possible for the customer.

When TPBank was restructured, we also revamped our lending products in various regions. We didn’t just offer generic business loans; we made sure each unit, even if small, conducted thorough research on their respective markets. This allowed us to tailor products and services for each target group and customer segment, ensuring they were as relevant and in tune with customer needs as possible.

In fact, with the same loan amount, if the process and procedures are streamlined and as convenient as possible for the customer, TPBank doesn’t need to compete on price. Moreover, thanks to our thoughtful product design, many of TPBank’s products have been very successful with low levels of bad debt, because they are “tailored” to meet the exact needs of the customer.

We Focus on Effectiveness

So, what does TPBank need to pay attention to and adjust when applying the "FMCG-oriented" approach to its banking services in general, and retail banking in particular?

The key focus is risk management. Banking is essentially a business of managing risk. For example, when you sell a loan or a credit card to a customer, it takes two years to know whether the product is successful, whether it will generate profits, or if it will lead to a loss of capital. In FMCG, once the product is sold, the transaction is usually complete.

Clearly, FMCG doesn’t face the complex risk management challenges that banks do. In addition to pure product risk, banks also face operational risks, ethical risks with employees, and so on, which means that the way we manage risks is quite different. To minimize risk and avoid errors, or at least ensure that errors are impossible, we need multiple layers of controls. We also need to ensure that, if we can’t avoid all risks, we have backup resources to cover any potential losses.

Risk is also related to risk appetite. If we are too strict, we won’t be able to lend, but if we’re too lenient, we risk losing money. The challenge is finding a balanced approach to risk management that creates a unified, reasonable risk appetite model. At TPBank, the risk management and legal departments operate independently, without being influenced by "directives."

In fact, the regulatory framework in the banking sector is very complex and strict. The biggest concern is internal leniency. No matter how tight the processes are, if they are not executed properly, risks remain. That’s why we maintain a very rigorous system to check that processes are being followed correctly.

Some banks build strategic products that account for a large share of their loan portfolios. Does TPBank follow a similar retail-oriented approach?

TPBank doesn’t have a key product. Our retail principle is "a hundred flowers blooming" — we don’t concentrate all our resources on one product.

For example, TPBank pioneered auto loans and was very successful, capturing the number-one market share. Later, many other banks entered this market, and some even made large investments, but we didn’t feel the need to fight to maintain the number-one position.

TPBank is fine with being in second place. Our goal is efficiency and achieving the expected profit, because putting all our focus on one product creates risk. We prefer a more balanced approach, with both large and small businesses, and individual customers, so that in any situation, we can survive.

If we concentrate all our resources in one area, the profit margin might not be as attractive. Retail banking is about diversification — you often have to "look at the vegetables to pick the meat," meaning you push one thing, but the actual goal is something else (laughs).

New Gold Mine with Digital Banking: Buy Now, Pay Later

TPBank is a pioneer in digital banking and has the dream of becoming a "small boy" who grows into a "big guy," with digital banking helping to balance the weakness of having too few branches and transaction offices. How far has this goal been realized?

When it comes to branch size, TPBank is still a mid-sized bank in the system. However, in terms of the number of customers, we are now approaching the scale of the larger, top-tier banks, with 13.5 million individual customers and nearly 200,000 corporate clients. It is precisely because we pioneered and excelled in digital banking that TPBank has been able to rapidly scale its customer base, while still providing great service even though the number of branches, transaction offices, and staff hasn't increased significantly.

Back in 2017-2018, our monthly transactions were less than 1-2 million per month, but now we are handling over 100 million transactions per month, which translates to 3-4 million transactions per day. These numbers show that the goal of "small boy becomes big guy" is gradually becoming a reality.

Thanks to being a pioneer in digital banking, we have built a large base of young customers—people who love online shopping, especially e-commerce. They are the present and the future of retail banking services in general, with a huge potential for growth.

Digital Banking Investment: A Key to Efficiency and Profitability

Nowadays, all banks are heavily investing in digital banking, but nearly all transactions on digital channels are free. How does TPBank make this significant investment work effectively and generate profit, especially with tens of millions of individual customers who mainly use the bank's app just for money transfers?

For TPBank, investing in digital banking is about dramatically increasing our service capacity and reducing costs. Just imagine, when the bank was restructured many years ago, it only had 10 branches and 15 transaction offices—how many customers could we serve then? And we were only allowed to open a maximum of 5 new branches per year. If we relied on our physical branches, TPBank would never have been able to serve tens of millions of individual customers, nor could we sustain the associated costs. For example, every time a customer comes in to conduct a transaction at the counter, we incur a minimum cost of about 30,000 VND, even though we don’t earn a single penny in return. If you multiply that by 3-4 million transactions a day, the costs would be enormous. However, if the transaction is done through digital channels, those costs decrease by many, many times.

Moreover, by pioneering in digital banking, we’ve also stayed ahead of the market by not just offering payment services and savings accounts, but also loans through digital channels, which are very convenient. When lending through digital channels, we manage according to IFRS9 standards—this means we account for potential future losses in advance and only proceed when we see it’s effective. In contrast, consumer credit lending before, following VAS standards, was more like "eating now, paying later" (laughs).

TPBank is leading the way in Digital Lending by partnering with e-commerce platforms like Shopee, Tiki, Lazada, and e-wallets such as Momo and Zalopay to offer Buy Now, Pay Later services. How does this work?

Customers see a product on an e-commerce platform and want to buy it, but if they don't have the money at that moment, they can submit a request to TPBank via digital channels. The bank will immediately assess, evaluate, and score the customer, and in just a few minutes, the customer will know if they are eligible to make the purchase.

This is a very promising area because Vietnam is still a society with lower consumer spending compared to developed countries. People still tend to have a mindset of saving and accumulating. The credit penetration rate among the population is still quite low. In contrast, in developed countries, borrowing to spend is very common, and a person’s salary alone can secure a credit limit many times over, allowing them to spend freely.

We currently have about 3 million customers using this service, and the prospects for growth are very positive.

The Future of TPBank's Consumer Credit Customers

What will happen to TPBank's "new gold mine" if many other banks start offering similar services?

If we can do it, others can do it too. It's very easy and fast to learn in today's market. It's hard to keep a secret, especially since personnel in the banking industry are quite... mobile! (laughs)

The issue is the system and the way to create such products—it won’t happen overnight. By the time others catch up, TPBank will have already gone quite far ahead. Moreover, consumer lending through digital channels isn't just about technology. It's also about the analysis model, the debt collection system... all of which need to be synchronized and operate effectively.

Here, developing a system that collects data, builds algorithms, creates scorecards to assess customers, and then grants credit, will take time. You can’t rush it. Especially when it comes to debt collection, which must be done in compliance with legal regulations—it's not easy, and it's a key factor in ensuring the effectiveness of this service.

In the past, TPBank also experimented with traditional consumer loans, like the financial companies, basically following the "if they’re doing it, we should too" approach. But after COVID-19, the market faced a crisis, we couldn’t recover debts, and many companies suffered heavy losses. So, we had to pivot, shift to digital channels, and the results have been completely different.

From TPBank’s experience with digital lending through Buy Now – Pay Later and traditional consumer credit, could you share more about the cost-benefit equation of these two models?

In fact, investing in digital channels is almost a one-time investment. For example, investing 10 billion VND in a system that serves 1 million customers means it costs, on average, just 10,000 VND per customer. Meanwhile, if we send staff to approach customers directly, the costs are much higher.

In the past, when financial companies offered traditional loans, the COA (Cost of Acquisition) — meaning the cost paid to personnel who go out to find customers — was already 8-10% of the loan amount. Not to mention the operational costs of traditional models, where the risk costs could be 20-30% or more. As a result, some loans required interest rates of 50-70% just to make a profit. And if customers stopped paying, the losses could be huge…

But with the new lending model, the bank doesn't have to go to each customer's home to collect debt. Instead, we can send a text message, an email, or make a phone call. However, the most important factor is how we evaluate the customer through digital channels, to identify the right lending targets. If a customer is responsible about repaying, a gentle reminder is enough, and the risk is much lower.

Digital lending not only saves on COA but also on operational costs. If traditional models incur around 20% in operational costs, digital channels only incur 1-2%. As a result, the bank can lower interest rates, making it easier for customers to repay their loans. The interest rate for consumer loans through digital channels can be as low as the rate for credit cards.

Moreover, once customers become accustomed to Buy Now – Pay Later services, they will gradually become loyal customers. This is the same for any customer. They start with a modest income of 7 million VND per month when they first start working, but after 5-7 years, they could earn tens of millions, and potentially even reach hundreds of millions. When customers become loyal to us, they will use more of our services. Right now, they are borrowing money, but in the future, they will also deposit money into the bank.

TPBank's Strategic Competitive Advantage

In reality, when looking at the retail products of banks today, there seems to be little clear or significant differentiation, and imitating similar services is not particularly difficult. What, in your view, is TPBank's strategic competitive advantage in retail banking?

From an external perspective, many of TPBank's retail services might seem similar to those of other banks. However, strategic competitive advantages are not built overnight—they are the result of a long process. As I mentioned earlier, it all started with a change in mindset towards customer service, making the customer the center of everything we do and designing services around that.

When it comes to service, we prioritize the customer journey, rather than just focusing on the general quality of service. As a result, when we build and design retail products, we focus on creating an experience that is as convenient and satisfying as possible for the customer.

A point that might be less noticeable to many people is that TPBank's Product Council includes senior bank leaders. Our team always emphasizes the importance of focusing on the details when designing any retail service. Some jokingly say that, in addition to applying marketing and distribution strategies from the FMCG industry to banking, TPBank is also meticulous about the details in service design, as if we were creating fine jewelry (laughs). The sophistication in the service experience is something we always strive for.

For example, take the experience of using the TPBank app. If you compare them at a glance, banking apps might seem similar. However, when you actually use it, the experience on the TPBank app is quite different. The difference comes from the fact that we pay attention to every little detail in the app experience, and we have an in-house team dedicated to developing this product, so we are not reliant on external partners. As a result, TPBank is able to continuously upgrade and improve the app to provide a faster, more convenient experience.

For example, just the money transfer feature alone—TPBank has developed a new "paste to pay" feature for ChatPay. So, whenever a user receives a transfer notification, instead of manually entering the details, they just need to copy and paste the information into the app. The AI in the TPBank app will automatically fill in the recipient's details—account number, bank, and transfer amount—into the corresponding fields. The customer just has to enter the message or purpose of the transfer and then confirm to complete the transaction.

This is a small example of the service experience on our app, but there are many similar features across our other retail services. It is this accumulation of small improvements and upgrades that enhance the customer experience, which builds strong customer loyalty and gives TPBank its strategic competitive advantage.

In the next 2-3 years, how will the convenience of retail banking at TPBank change?

Gradually, TPBank customers will be able to handle all basic banking needs through digital channels, with the exception of more complex services that will still require assistance from bank staff. For example, buying a car or a motorbike—within the next 2-3 years, customers will be able to apply for a loan without even needing to visit the bank.

We will also continue to digitize as much as possible and eliminate the use of paper. Contracts can be signed digitally through electronic signatures. The overall banking experience will certainly become faster and more efficient.

In the future, the way we compete will be very different from today. One day, "price" will be standardized across the market, and it will be difficult to bargain as we did before. With interest rates being more or less the same, any small differences will be acceptable, and customers will choose based on ease of access, simple procedures, and fast transactions.

Thank you very much!

Lên đầu trang